The future is digital-first, and the financial services industry is under tremendous pressure to embrace the wave of digital transformation or risk being swept away by the competition—especially those that are born digital or born-in-the-cloud. Huawei is playing a central role in enabling their successful transition, partnering with banks and financial institutions worldwide to drive innovation and enable digital transformation for one of the most critical sectors in society.

Huawei’s now primordial—and ever-growing—role in the financial services industry was the overarching theme of the “Huawei Intelligent Finance Summit 2022,” a hybrid conference held from the 20th to the 21st of July in Singapore.

Ryan Ding, President of the Enterprise BG at Huawei, formally kicked off the summit with his keynote, “Diving into Digital for a Brighter Future — Create New Value Together,” where he talked about the digital-first future that awaits the post-pandemic world.

At the Summit, Huawei Cloud shared three trends of digital transformation in the financial industry:

- All-cloud. Organisations across industries are leveraging the cloud more and more, and financial institutions are doing the same. Moving forward, more banks and similar institutions will be migrating to the cloud, first doing so with their peripheral systems and then even their core systems.

- Bi Data and AI convergence. The intersection of Big Data and AI is bound to usher in a new era of intelligent governance, enabling financial organisations to better leverage their data and derive more value from it.

- All-cenario intelligent connection. The physical and virtual worlds are merging, and the lines that separate them are blurring. This fact was underscored by the author Birch in his keynote, “New Finance in the Metaverse Era,” and this merge will soon create experience-centric, inclusive finance for all.

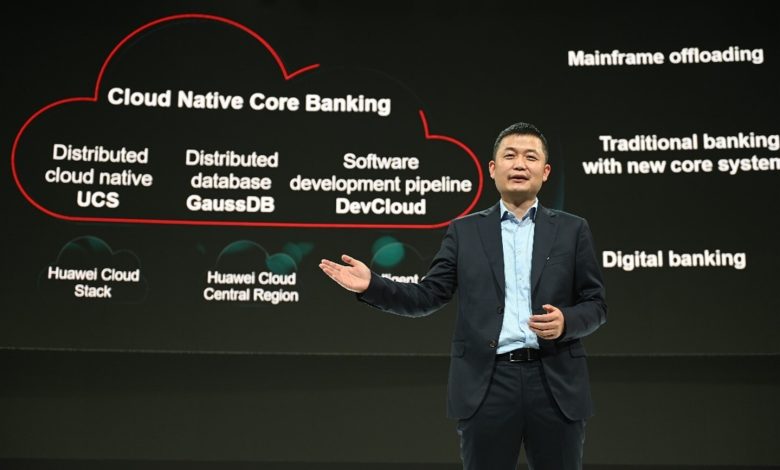

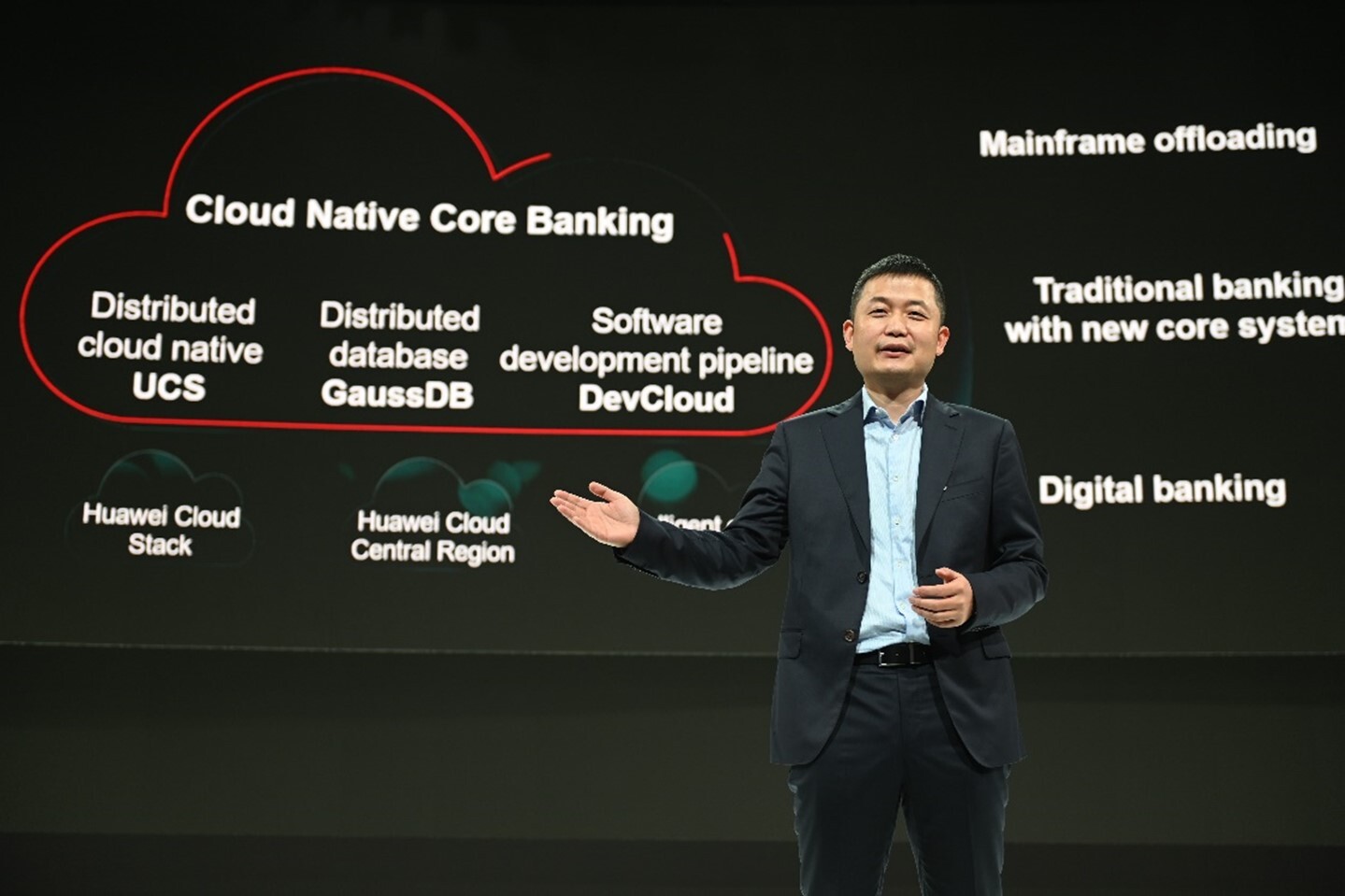

Huawei Cloud executives also gave keynote speeches that covered at length about the company’s growing portfolio of cloud-based finance industrial solutions that span various technologies, including the star of the summit: Huawei’s Cloud-Native Core Banking solution. William Dong, President at Huawei Cloud Marketing, formally introduced this solution in his keynote, “Huawei Cloud: Everything as a Service for Smart Finance.”

William Dong delivering the speech Huawei Cloud: Everything as a Service for Smart Finance

Huawei’s Cloud-Native Core Banking Solution Set to Redefine the Cloud for FSI

Developed by Huawei Cloud, this Cloud-Native Core Banking solution is the foundation for agile innovation of both traditional and digital banks. It aims to provide a stable cloud-native platform for offloading mainframes, building new core systems for traditional banks and powering digital banks. Huawei’s Cloud-Native Core Banking solution features, among others, large-scale concurrency and agile application iteration. Critically, it enables high availability, as evidenced by its Recovery Point Objective (RPO) of zero and Recovery Time Objective (RTO) of less than 2 minutes.

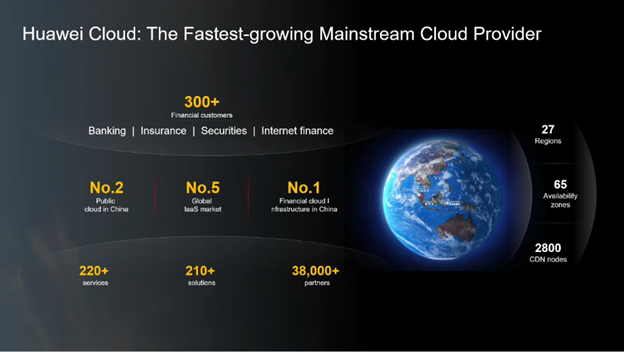

Dong, who began his keynote by taking a brief look back at Huawei Cloud’s humble beginnings in 2015 and its meteoric rise since then, noted, “We are the fastest-growing mainstream cloud provider. Huawei is one of the top five cloud providers globally . . . and for finance, we have served more than 300 customers globally. We have launched our service in the Asia Pacific, in Europe, in Africa and in the Middle East.”

Expect Huawei Cloud’s client base in the financial services industry to grow even more, what with its Cloud-Native Core Banking solution addressing the three finance-related trends in digital transformation outlined by Huawei. Its Ubiquitous Cloud–Native Service (UCS), for instance, is an ideal solution for financial institutions that are, according to Dong, “levelling up their cloud strategies” with its one-click application data migration, intelligent computing scheduling and all-domain traffic governance, among others.

Huawei’s Cloud-Native Core Banking solution will also be at the forefront of the Big Data and AI convergence, which will enable financial institutions to derive the most out of their precious data. Making this interplay possible are Huawei Cloud’s Gauss Database (GaussDB) and the Huawei Cloud Data and AI Convergence Platform. The former is a financial-grade distributed database that serves as a one-stop core for data analysis. The latter, meanwhile, enables data consolidation and allows AI to make sense of the resulting data lake.

Building and Innovative Cloud Built on Trust—One Client at a Time

Ultimately, one of Huawei’s biggest goals is to build trustworthy and innovative cloud services for customers. Zeng Xingyun, President of Huawei Cloud APAC, touched on this goal in his afternoon session titled, “Building a Trusted and Innovative Cloud for the Financial Industry.”

According to Zeng, Huawei Cloud will focus on “Infrastructure-as-a-Service, Technology-as-a-Service and win-win results with cloud ecosystem partners,” to continuously improve the core competitiveness of Huawei Cloud. It will also zone in on “deep digital transformation, accelerate cloud-native and service innovation and build the best To-B service” to continuously create value for customers and partners.

Innovation: Needed More Than Ever by the Financial Services Industry

A case can be made that the financial services industry stands to benefit the most from innovative digital solutions. After all, institutions in this industry need fast, reliable, real-time services to serve their clients well, all while facing the very real risk of fraud and security breaches. The cloud is able to deliver all of these powerful capabilities without requiring tremendous up-front investments like in years past.

Best believe that Huawei is aware of the many pressing needs of the industry and is, at this very moment, innovating modern, digital-first solutions to these very same needs.

Click HERE to learn more about Huawei Cloud, one of the world’s leading mainstream cloud providers.